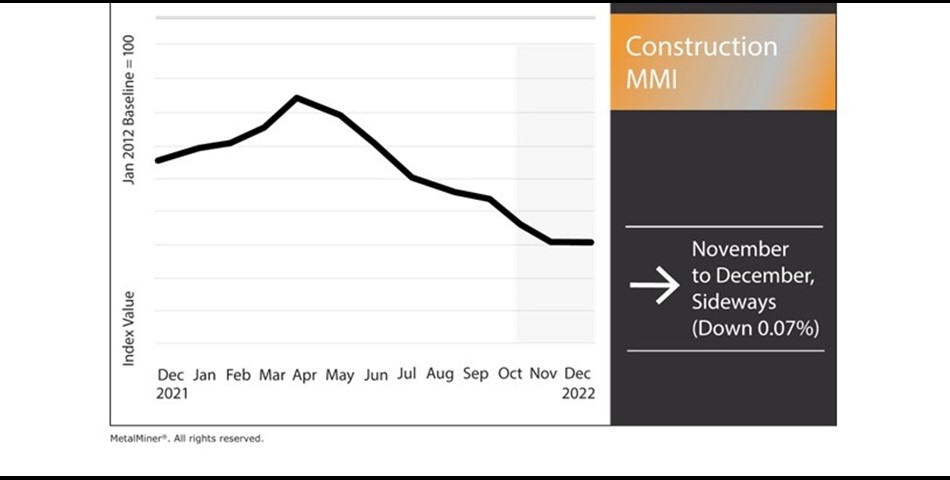

The Construction MMI (Monthly MetalMiner Index) flatlined sideways, moving downward by a meager 0.07%. The overall volatility of metal prices remains a primary challenge to the index.

The near-stationary index contrasts starkly with the downward 2022 trend. Aside from fluctuating metal prices, the industry also had its integrity tested by several other problems. These included rising interest rates, labor shortages, energy shortages globally, and zero-COVID.

Month-over-month, most bar-fuel surcharges remained within a sideways trend. Such has been the case for the past couple of months. The only exception is the Weekly Midwest, which rose considerably ($0.16 per mile). Meanwhile, European commercial 1050 aluminum sheets also increased in price quite a bit. This was mostly due to ongoing energy shortages and the arrival of the colder months. These compounding issues have left European production in a tight spot.

However, Chinese steel rebar prices shot up. This channel likely resulted from uncertainty about zero-COVID restrictions and concerns over a potential incoming squeeze on Chinese steel products.

U.S. Construction Expected to Boom, But are Supply Chains?

High-interest rates heavily impacted the 2022 construction industry. However, experts feel U.S. construction will expand steadily in the long term, particularly over the next 5-10 years. That said, one question remains: can supply chains keep up? Not only will supply chain woes affect metal prices, but the entire industry.

A recent article highlighted how the pandemic caused numerous people to move out of cities to more suburban areas in search of more affordable housing. This eventually spurred a massive influx of housing construction. Over the next several decades, these homes will undoubtedly require repairs and upgrades.

However, with global supply chains disrupted by the pandemic, energy shortages, and the ongoing situation within China, an easy recovery for global supply chains isn’t likely. In fact, they could take years to rebuild. Obviously, this poses a significant problem. Indeed, building materials like steel rebar and aluminum plate have already felt the strain of zero-COVID. Therefore, U.S. construction will likely remain strained in the short term.

Metal Prices: Will Steel Rebar Go Up More, or is This a Dead Cat Bounce?

MetalMiner’s Raw Steels MMI for December discussed various forms of steel potentially bottoming out. The steel market, for most grades and forms, remains in a questionable state. With China considering easing zero-COVID restrictions, some metal prices continue to rise. Meanwhile, fears of metal squeezes could have also contributed to things like steel rebar rebounding. The question is: how long will the rebar uptrend continue?

The market appears to have both bullish and bearish factors tugging on it. What’s more, the world is still uncertain as to if and when China will ease zero-COVID. This puts a lot of strain on the Chinese-sourced steel and steel rebar market. While U.S. construction materials have recently faced demand shortages due to high construction costs, the short-term path for rebar remains uncertain.

Metal Prices: Construction MMI Biggest Price Shifts

- Chinese rebar rose sharply by 11.32%. Prices at month’s start sat at $581.10.

- European 1050 aluminum sheet rose by 8.33%. Prices at month’s start sat at $3987.28.

- The Weekly Midwest bar fuel surcharge dropped by 4.87%. Prices at month’s start sat at 0.78 per mile.

- H-beam steel increased slightly by 1.84%. Prices at month’s start sat at $529.58.

Jennifer Kary